Title: Understanding Small Cloud Technology Loan Notes

Introduction to Small Cloud Technology Loan Notes

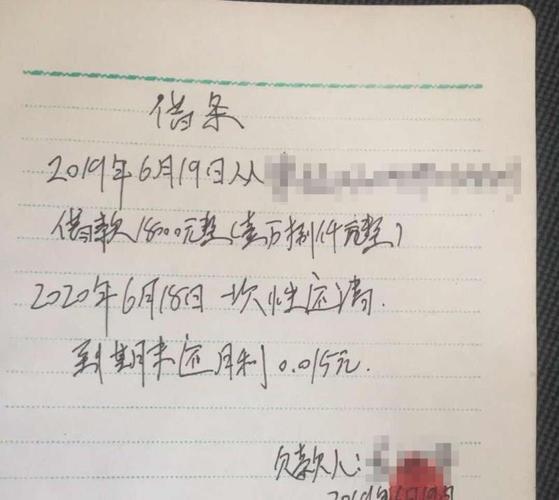

Small Cloud Technology Loan Notes refer to financial instruments utilized by Small Cloud Technology, a company specializing in cloud computing solutions, to raise capital. These loan notes serve as a means for investors to lend money to the company in exchange for periodic interest payments and eventual repayment of the principal amount.

Key Features of Small Cloud Technology Loan Notes

1.

Interest Rate:

The interest rate on Small Cloud Technology Loan Notes typically depends on various factors such as prevailing market rates, the company's creditworthiness, and the terms negotiated between the company and the investors.2.

Term:

The term of Small Cloud Technology Loan Notes can vary, ranging from shortterm notes (typically less than a year) to longterm notes (up to several years). The company and investors agree upon the duration of the loan, which determines the repayment schedule.3.

Repayment Structure:

Small Cloud Technology may choose to repay the principal amount of the loan notes in one lump sum at maturity or in installments over the term of the notes. The repayment structure is outlined in the terms and conditions of the loan agreement.4.

Security:

In some cases, Small Cloud Technology Loan Notes may be secured by company assets or backed by a guarantee from the company or a third party. This provides investors with added security in case of default.5.

Convertible Option:

Small Cloud Technology may offer a convertible option to investors, allowing them to convert their loan notes into equity shares of the company at a predetermined conversion ratio. This provides investors with the opportunity to participate in the company's growth potential.Benefits of Small Cloud Technology Loan Notes

1.

Flexible Financing:

Small Cloud Technology Loan Notes offer the company flexibility in raising capital without diluting existing ownership or control. This allows the company to fund its operations, invest in growth initiatives, or manage shortterm liquidity needs.2.

Interest Payments:

Investors in Small Cloud Technology Loan Notes receive periodic interest payments, providing them with a steady income stream. This can be attractive to investors seeking fixed income opportunities in a lowinterestrate environment.3.

Diversification:

For investors, Small Cloud Technology Loan Notes offer a way to diversify their investment portfolio beyond traditional stocks and bonds. By investing in corporate loan notes, investors can potentially enhance portfolio returns while managing risk.4.

Alignment of Interests:

By participating in Small Cloud Technology Loan Notes, investors align their interests with the company's performance and success. As the company grows and generates profits, investors benefit from both interest payments and potential capital appreciation.Considerations for Investors

1.

Risk Profile:

Investors should carefully assess the risk profile of Small Cloud Technology Loan Notes, considering factors such as the company's financial health, market conditions, and industry dynamics. Higher returns are often associated with higher risk, and investors should be prepared to potentially lose some or all of their investment.2.

Due Diligence:

Conduct thorough due diligence before investing in Small Cloud Technology Loan Notes. Review the company's financial statements, management team, competitive positioning, and growth prospects. Additionally, assess the terms and conditions of the loan agreement to understand the rights and obligations of both the company and investors.3.

Diversification:

As with any investment, diversification is key to managing risk. Investors should avoid concentrating their investment portfolio in a single asset or asset class. Instead, spread investment across various asset classes, sectors, and geographies to mitigate risk and enhance longterm returns.4.

Exit Strategy:

Consider your exit strategy when investing in Small Cloud Technology Loan Notes. Determine whether you plan to hold the notes until maturity, sell them on the secondary market, or exercise any convertible options. Having a clear exit strategy can help you make informed investment decisions and manage liquidity needs.Conclusion

Small Cloud Technology Loan Notes offer an opportunity for both the company and investors to achieve their financial objectives. By understanding the key features, benefits, and considerations associated with these financial instruments, investors can make informed decisions that align with their risk tolerance, investment goals, and overall financial strategy.

免责声明:本网站部分内容由用户自行上传,若侵犯了您的权益,请联系我们处理,谢谢!联系QQ:2760375052